Buying property Dubai : Whether it’s the allure of a luxurious lifestyle or the temptation of living tax-free, moving to Dubai is an option that many potential expats have considered.

Thanks to the plentiful malls and beaches, thousands of high-end shops and restaurants, bustling industry as well as activities like dune surfing or outdoor-activities-made-indoor like skiing, both visitors and prospective residents alike find it hard to miss the many advantages to living in the middle eastern city.

If you’re looking to invest or considering a move – whether it’s for work, to start a business, or just to enjoy life in Dubai – you’ve probably already considered buying property in the emirate. Thanks to the passing of 2002’s Freehold Law, doing so is a distinct possibility, with foreigners retaining the right to buy, sell and rent property in Dubai without any special regulations or permissions. And, with more than 70% of the emirate’s population made up of expats, it’s not at all uncommon for foreigners to purchase land and homes.

That being said, a similar number of residents – just under 70% – don’t own their own property in the city. There are a few reasons for this, though many residents cite their lack of surety about how long they’ll stay in the emirate as their reason for renting. Another big roadblock? The required 25% deposit you’ll have to put down when buying a home. If you can get past those hurdles, however, owning property can be your ticket to an excellent investment or a seriously fun lifestyle.

Regardless, it’s important to understand all the intricacies of buying property in Dubai before deciding to make a purchase. This guide will walk you through what you need to know about buying your own place in the emirate.

Buying property Dubai

What’s the property market like in Dubai?

The property market in Dubai has suffered a series of rises and falls in recent years, though the market as a whole is considered to be generally steady. That being said, housing prices fell 17% between 2014 and 2016, and are likely to fall even further in 2017 despite a small rise in December 2016. At the moment, experts are somewhat divided between considering this the market bottom – and predicting a steady rise from here – and predicting a further fall before the trend reverses.

All in all, this may be a good time to buy vs. renting in Dubai, as property prices are low for the area and will eventually rise, as the UAE Dirham is inextricably tied to the currently strong U.S. dollar. ( Buying property Dubai)

Can foreigners buy property in Dubai?

Yes. Thanks to legal changes in 2002, foreigners can buy, sell and rent property in Dubai without any special regulations or permissions.

How can I find a property in Dubai?

There are three main “types” of property you can buy as a foreigner in Dubai, and each of them typically correlates to a different style of land or home.

Freehold properties

Typically seen as the most desirable, freehold property is often sought by foreigners looking to invest. Freehold properties are entirely yours, and can be sold, rented and passed on as inheritance as you wish. The freehold property type is most often associated with undeveloped land parcels, versus homes or apartments, however it isn’t uncommon to buy pre-fabricated homes in a freehold arrangement.

If you’re going to buy a freehold property, you’ll need to purchase it from a real estate developer that’s been approved by the emirate’s government.

Buying property Dubai

The top five approved developers include:

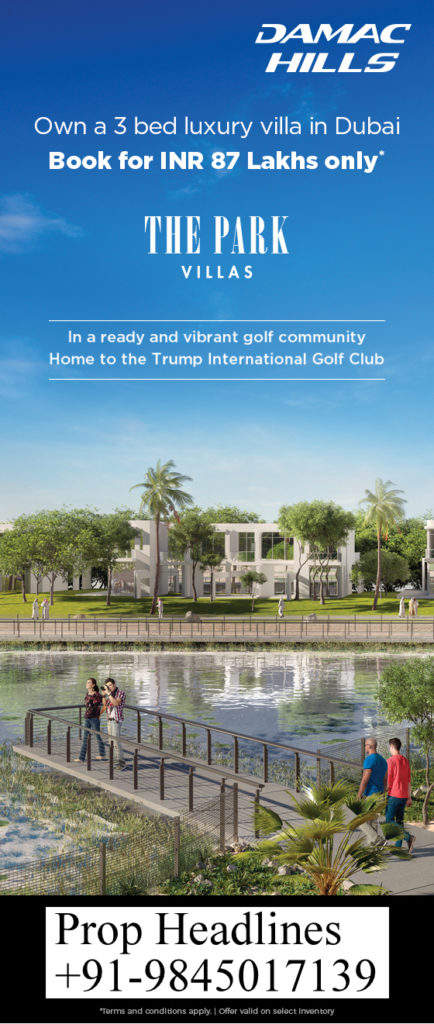

Damac Properties

Emaar

Nakheel

Dubai Properties

Usufruct properties

Another type of property arrangement is usufruct*,* which essentially translates to a long-term lease. You can do whatever you want with an usufruct property, except for destroying it. These types of leases last from 10-100 years, depending on whether you’re buying commercial or residential property and your negotiations.

Commonhold properties

The final type of property is commonhold, which are most like condominiums in other countries. Owning a commonhold property gives you the right to buy, sell, rent or pass the property down as an inheritance, much like a freehold property. However, commonhold properties are typically apartments, and owners are required to pay maintenance fees for the building and its common areas, which are most often owned by the developer.

How do I choose the right property?

As you begin your property search, it’s a good idea to keep a couple of things in mind.

Traffic is important

Traffic in Dubai is notoriously bad, and roads running from Sharjah into Dubai can be a nightmare. If you’re going to have to commute into the center of the city, it’s important to consider distance and even run a test drive before settling on a property.

Choose the right neighborhood

Location, location, location. Whether it’s to live or invest, choosing a good neighborhood is essential for enjoying Dubai, and picking the right one will seriously up the rental value if your plan isn’t to live there.

Some of Dubai’s most popular neighborhoods include:

Damac Hills

Dubai Marina

Al Barsha

Garhoud

International City

The Greens

Buying property Dubai

Pay attention to parking

If you’re buying a prefabricated home or apartment, you may not be thinking of parking as a number one priority. In Dubai, however, purchasing property that doesn’t come with some type of covered car park can be a huge mistake. Thanks to summer temperatures around 50ºC (122ºF), cars that are left outside are not only unbearable to drive, they tend to deteriorate quickly.

What are the steps to buying a property as a foreigner?

Some of the key steps to take for property buying include:

Determining what type of property you’ll buy: a villa or apartment, a plot of land, or even commercial space.

Conduct an online search for available properties.

Contact a real estate agent or, more commonly, contact a developer directly.

Ensure you’re eligible to purchase land; you must be legally allowed to live in Dubai, and you must have a steady salary.

Choose a property.

Pay your deposit.

Get a mortgage or home loan from a reputable financial institution.

Transfer deeds.

Pay land registry tax.

Buying property Dubai

What are the legal requirements to buying a property in Dubai?

-If you do encounter any problems during this buying process, it’s advisable to seek legal advice from a local lawyer in Dubai. Additionally, any type of disagreement between the buyer and seller should also be reported to the Real Estate Regulatory Agency (RERA). Adhering to this advice can help you avoiding scams & pitfalls

How do deposits, down payments, mortgages and bank loans work?

Realistically, most prospective property owners in Dubai will need to get a loan or mortgage in order to make a purchase.

Choosing a bank

Mortgages and loans can be taken out from pretty much any reputable financial institution, but some of the most favored are Mashrek, Emirates NBD and HSBC. While technically all of these banks will loan to foreigners, you may find that you have better luck at a large international bank, like HSBC, then you would at the local banks.

Ultimately, if you have excellent credit and proof of a decent salary, you should qualify for a mortgage or home loan in Dubai. The best way to find out is to take your documentation to a bank you already work with in the emirate. If you’re not already banking in the city, it’s a good idea to learn how to open up a bank account in Dubai to start. ( Buying property Dubai)

Buying property Dubai

Typically the documents you’ll need to apply for a loan include:

Passport (and passport copies)

Proof of residence/ visas

Proof of current address

Salary certificates of proof of income

Bank statements going back six months to a year

If you do get a mortgage, you’ll find the most popular installment plan spans 15 years. The maximum length of a mortgage plan you can get in Dubai is for 25 years. The monthly payment on your mortgage cannot be more than 35% of your net household income, and the total amount of the mortgage cannot be set above 60 times your combined monthly household income.

If your credit is truly excellent, you may qualify for pre-approved financing at some Dubai banks. If you do, you can get a loan before you’ve chosen your property, which can speed up the whole purchase process and is super desirable for sellers.

While it’s less common, it’s possible to take out a personal loan in your home country and use those funds towards a home in Dubai. If you can get a mortgage in the Emirate, however, you’ll be better off. Most foreign banks aren’t eager to issue loans for homes in what’s considered a high-risk real estate market. ( Buying property Dubai)

Buying property Dubai

Deposits / Down payments

It’s important to consider, however, just how much money in total you’ll need to fork over at the start of your purchase. That is — the down payment on a home in Dubai is typically 25% of the total price, and some developers selling off-plan properties will require you to put down 100% up front. That number can add up to something staggering, so it’s important to have a pretty large nest egg or be able to take out a sizeable loan in order to buy your property.

If you’re planning to make your down payment from abroad, you’ll want to use a service like TransferWise who shows all the fees upfront and gives you the real exchange rate – the one you find on Google. Because the amount itself can be so astronomical, keeping the associated fees down will be essential for saving money.

With that, you’re all set to start looking at homes and plots in Dubai. Good luck in your property search!

Call +91 – 9845017139 / +91 – 9845044734 / + 91 – 9845064533 / 080 – 42110 448 / 080 – 42124147 / 080 – 49598502 to Know more about buying Property in Dubai

Book mark our Website to get latest Updates, http://propheadlines.com, Stay in touch in our Face book page https://www.facebook.com/propheadlines/